|

» Return

This article was originally posted on

03-26-2014 Tax Relief to more than 1 Million Minnesotans Dear Neighbors and Friends,

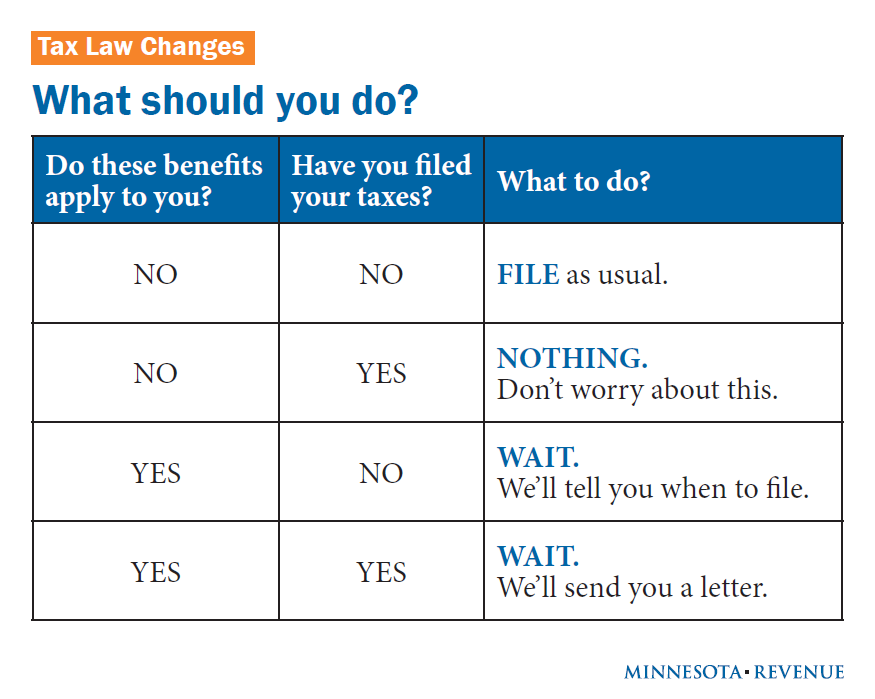

Last week, the House continued their quick pace by passing a bill to offer tax relief for more than a million middle class Minnesotans. Governor Dayton signed it into law just a few hours later. Much of the tax relief offered in this bill will come through conforming the state tax code to the federal tax code. It helps makes the process simpler for those filing taxes and for those who process them. But because this change took place during tax season, I'm sure you may have questions about how this bill will impact your 2013 tax return. What benefits were added for the 2013 returns? 1. Working Family Credit 2. Mortgage Insurance Deduction 3. Mortgage Debt Forgiveness 4. Deduction for Educator Expenses 5. Higher Education Tuition Deduction 6. Student Loan Interest Deduction 7. Education Savings Accounts 8. National Health Corps Scholarships 9. Employer-Provided: Education, Adoption, Transit 10. Tax-Free Charitable IRA Distributions The bill provides $49 million in tax relief for 2013 through these ten deductions and credits. If you aren't sure whether you qualify for one or more of these tax benefits, follow the link HERE to see more details. What should I do with my tax return? Once you know whether you qualify for these benefits or not, use this simple chart to help determine what you need to do next.

If you qualify for one of the benefits listed above AND you haven't filed your tax return yet, the Department of Revenue is asking that you wait until April 3rd to file your return. At that point, all of the necessary changes will have been made to the software that is used to process state returns. What will happen after I file my return? You won't need to do anything right way. If you've already filed, or if an amended tax return is needed, the Department of Revenue will contact you by mail sometime after April 15. What if I have more questions? More information is available at the Department of Revenue website (HERE). If you still have questions, please don't hesitate to contact me by phone (651-296-3533) or email (rep.sandra.masin@house.mn). I'm always happy to help with any issues you might have. Rep. Sandra Masin » Return |

Your VOICE IS IMPORTANT!

VOTE!

The PRIMARY Election will be held on August 9, 2023. It is important that

you vote on this date to affirm your choice of candidate in the GENERAL election in November.

The 2023 GENERAL Elections will be held on November 7, 2023.

|